A Digital Only Philosophy

Instead of spending money on branches, tellers, loan officers, and private bankers trying to sell you something you don't need, we've invested in software.

Easy Payments

Select recipient and send money wire, or instant internal transfer.

Bank Grade Security

All data is SHA-512 encrypted at rest and in transit; 100% hosted behind AWS firewalls.

User Permissions

Manage access, approval rights, and transfer limits at user and account levels.

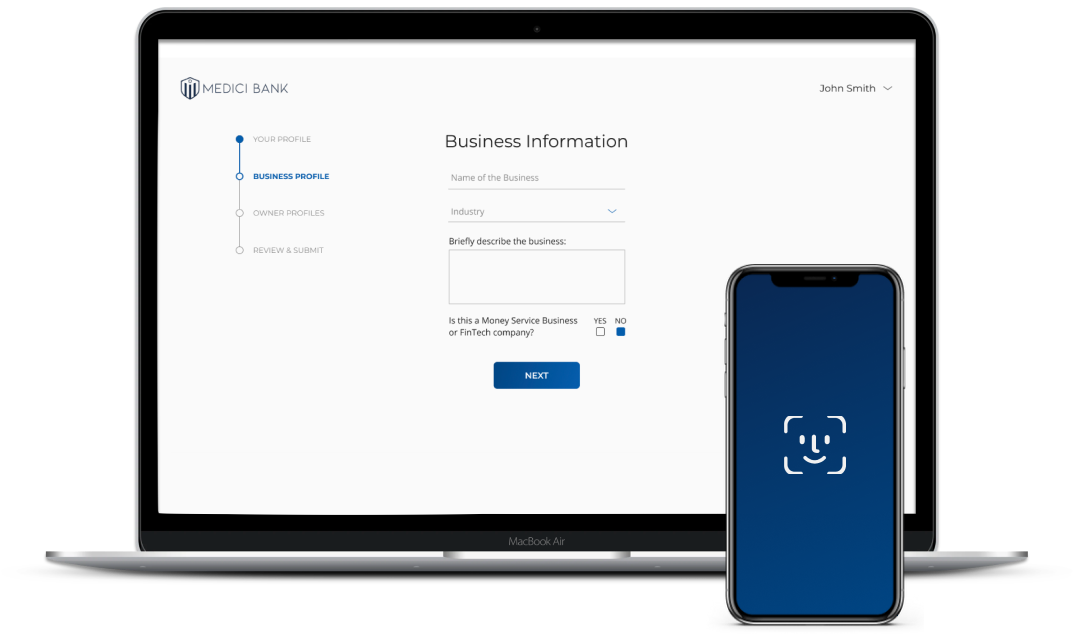

Multi-Factor Authentification

Smartphone app based multi-factor authentification to log in and transfer.

Multi-Level Approvals

Have up to 4 levels of approval based on custom transfer amounts.