Introduction:

For decades, Certificate of Deposits (CDs) have been a popular savings option. But how have they fared in the face of a changing economic landscape? Let’s analyze the historical trends of CD rates (1984–2024), explore trends and future predictions, and introduce the rising influence of digital banks in the savings arena.

Interested in opening a CD Account? Get started here.

A 40-Year Journey of CD Rates:

Our journey begins in the high-inflation years of the mid-1980s, where CD rates skyrocketed. We’ll delve into each decade, exploring the economic factors like the dot-com bubble burst and the Great Recession that shaped these rates.

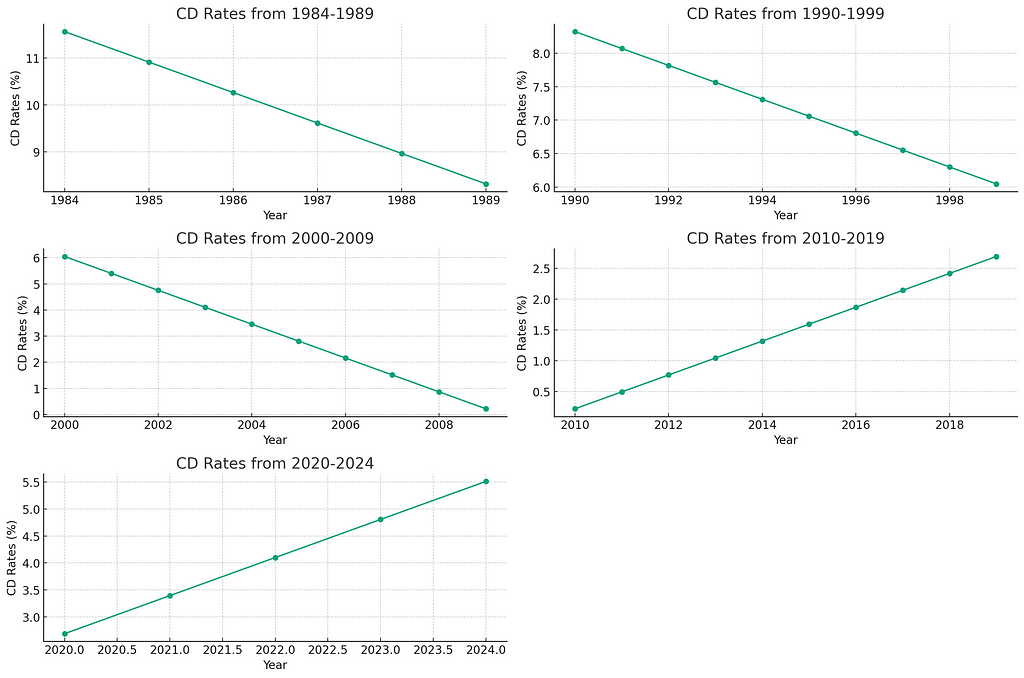

The line charts for each decade showcase the historical rates for three-month CDs, illustrating how they have responded to different economic climates from 1984 to 2024:

- 1984–1989: A period of high interest rates starting in the mid-1980s, reflecting a high-inflation environment, with rates gradually decreasing towards the end of the decade.

- 1990–1999: The rates continued to decline throughout the 1990s as inflation stabilized and the economy grew steadily.

- 2000–2009: This decade saw a significant drop in rates, particularly after the dot-com bubble burst and leading into the financial crisis of 2007–2008.

- 2010–2019: Rates remained at historical lows due to prolonged monetary easing policies following the financial crisis.

- 2020–2024: There is a noticeable uptick in rates as the economy begins to recover from the COVID-19 pandemic, with central banks starting to tighten monetary policy in response to inflationary pressures.

The recent surge in CD rates is a direct response to post-pandemic inflation.

A Line Through Time:

This line chart showcases how national average interest rates for savings accounts and CDs have fluctuated over the past five years, influenced by federal economic policies and market trends. This visualization will highlight the consistent outperformance of digital banks compared to their traditional counterparts.

Over these years, you can see a significant dip occurring in 2020 and 2021, coinciding with the economic impacts of the COVID-19 pandemic, which led to lower interest rates as central banks attempted to stimulate economic activity.

However, there’s a recovery in rates by 2023 as the economy begins to stabilize and improve, reflecting a return to more normal conditions and possibly tighter monetary policies responding to inflationary pressures.

This trend provides useful context for understanding the recent shifts in CD rates and their implications for savers and investors.

Looking Ahead: What the Crystal Ball Shows:

In today’s economic climate, interest rates are significantly higher than historical averages, this presents a strategic opportunity for savers to boost their financial wealth. Leveraging higher-yielding Certificates of Deposit (CDs) can profoundly impact savings growth. By actively managing where to park their savings, individuals can take advantage of these higher rates to accelerate their financial goals, such as building an emergency fund, saving for a down payment on a home, or simply growing their wealth more efficiently. This approach not only capitalizes on current market conditions but also provides a buffer against potential inflation, ensuring that savings retain, if not increase, their purchasing power over time.

To empower your savings strategy, we’ll provide two key visuals:

Here are the current national average annual percentage yields (APYs), according to Bankrate’s most recent survey:

- 3-month CD yield: 1.51 percent APY

- 1-year CD yield: 1.76 percent APY

- 3-year CD yield: 1.41 percent APY

- 5-year CD yield: 1.44 percent APY

Beyond Rates: Strategic Savings with CDs:

Understanding historical trends, current rates, and inflation expectations is crucial when deciding between short-term and long-term CDs. Here’s a breakdown to help you optimize your savings goals:

Very Short-Term CDs (3 and 6 Months):

Benefits:

- High Liquidity: Very short-term CDs are ideal for investors looking for high liquidity. These CDs allow you to access your funds relatively quickly, which can be beneficial if you anticipate needing the cash in the near term.

- Frequent Access to Potentially Higher Rates: With terms as short as 3 or 6 months, these CDs allow you to frequently reassess and reinvest at potentially higher interest rates, particularly beneficial in a rising rate environment.

- Lower Commitment: These CDs require a shorter commitment of funds, reducing the opportunity cost of locking in rates and allowing for greater flexibility in financial planning, especially useful for those uncertain about long-term investment decisions.

Considerations:

- Lower Yields: Very short-term CDs typically offer lower yields compared to longer-term CDs. This is a trade-off for the increased liquidity and lower commitment they offer.

- Rate Fluctuations: While the ability to reinvest frequently can be an advantage in a rising rate environment, it also means you may have to reinvest at lower rates if the interest rate environment declines.

- Cost of Frequent Reinvestment: Each time a CD matures and you choose to reinvest, there may be costs or lost interest during the transition period. Additionally, constantly managing the reinvestment of very short-term CDs can require more of your time and attention.

- Inflation Risk: Although these CDs allow you to reinvest more frequently, there’s still the risk that inflation could erode the purchasing power of your returns if the rates do not adequately compensate for the inflation rate.

Short-Term CDs (1–3 years):

Benefits:

- Flexibility: Shorter terms offer greater flexibility if you need access to your money sooner than expected. This could be useful for upcoming expenses or emergencies.

- Potentially Higher Liquidity: Short-term CDs often come with lower early withdrawal penalties compared to long-term ones.

- Alignment with Inflation: If inflation is rising, short-term CDs allow you to reinvest your money more frequently to potentially keep pace with inflation. You can take advantage of potentially higher rates as they become available.

Considerations:

- Lower Rates: Historically, short-term CDs have offered lower interest rates compared to long-term CDs. This means you might sacrifice some potential earnings.

- Missed Out on Rate Increases: If you lock into a short-term CD and rates rise significantly, you might miss out on the opportunity to earn a higher return on a longer-term CD.

Long-Term CDs (4–10 years):

Benefits:

- Higher Rates: Traditionally, long-term CDs offer higher interest rates than short-term CDs. This translates to potentially greater overall earnings on your savings.

- Predictable Growth: Locking into a long-term CD provides a guaranteed interest rate for the entire term, offering predictable growth for your savings.

Considerations:

- Limited Flexibility: Your money is inaccessible for the entire term. Early withdrawal penalties can be significant, potentially eroding your earnings.

- Interest Rate Risk: If inflation rises unexpectedly, your locked-in rate may not keep pace, reducing your purchasing power in the future.

With inflation a concern, a “laddering” strategy can be a good option. This involves investing in CDs with varying maturities (short, medium, and long-term) so that some CDs mature periodically, providing access to funds and the opportunity to reinvest at potentially higher rates.

How Online Banks are Changing the Game

In today’s dynamic financial climate, savers are actively seeking the best returns.

Interest Rate Showdown: Who Wins?

Recent data highlights a compelling trend: digital banks are leading the charge with the highest interest rates for savings accounts and CDs. This advantage stems from their lower overhead costs and technology-driven investment strategies.

The column chart above compares the current 1-year CD rates among various banks alongside the national average:

- Popular Direct: 5.15% APY

- BMO Alto: 5.05% APY

- Bread Savings™: 5.25% APY

- National Average: 1.81% APY

- Medici.Bank : 6.18% APY

Digital banks often provide more competitive interest rates on products like CDs, savings accounts, and loans, primarily due to their significantly lower operating costs compared to traditional banks. The absence of physical branches eliminates the need for extensive real estate investments and the ongoing costs associated with maintaining numerous locations. Furthermore, digital banks leverage automation and advanced digital technologies to handle transactions, customer service, and account management, which substantially reduces their labor costs. This efficient operational model allows them to pass the savings on to customers in the form of higher interest rates and lower fees, making their financial products especially attractive for savvy savers and investors looking for better returns on their deposits.

Medici Bank offers the highest APY among the displayed options, significantly above the national average, showcasing its competitive edge in the digital banking space. This visual representation highlights how Medici Bank stands out in terms of offering higher returns on 1-year CDs compared to other banks and the national average.

The Challenges of Tradition:

The competitive rates offered by digital banks pose a significant challenge to local institutions. These challenges include the pressure to raise rates, higher susceptibility to local economic downturns, and exposure to sectors with increasing risk, such as commercial real estate loans.

Strength in Numbers: The Power of Diversification:

Spreading investments across sectors and geographies is a key strategy for risk mitigation in banking. National and international banks, including digital ones like Medici Bank, leverage diversification to benefit both the bank and their depositors by offering higher and more stable returns.

Making The Choice:

Here are some questions to guide your decision:

- What are your short-term and long-term savings goals? Do you need access to your money soon, or are you saving for a future goal several years down the line?

- How comfortable are you with locking into a rate? Consider your risk tolerance and how comfortable you are committing to a specific rate for an extended period.

- What are your inflation expectations? If you anticipate rising inflation, a short-term CD may allow you to reinvest and potentially keep pace with inflation.

Conclusion: Reimagine Your Savings Strategy

As the banking landscape evolves, it’s crucial for savers to explore their options beyond local banks. Digital banks are emerging as strong contenders in the savings market, offering attractive interest rates and robust risk management practices. By understanding historical trends, analyzing current market conditions, and considering the rise of digital banking, you can make informed decisions to maximize your savings and secure your financial future.

Author Bio:

Edward Boyle, the CEO of Medici Bank, a leading digital bank based in Puerto Rico, shares his insights on the forefront of digital banking innovation. Medici Bank is committed to providing high-yield savings accounts and global financial solutions to empower your financial well-being.

[us]