The Bitcoin halving (or havening) directly influences the supply of Bitcoin, and indirectly, can impact the price of bitcoin and the broader cryptocurrency market.

Defined Supply of Bitcoin

JP Morgan CEO Jamie Dimon might not know it, but the supply of bitcoin has been predetermined and codified (literally) into the open source (ie publicly auditable) software that runs the bitcoin network via thousands of concurrent (distributed and unrelated) computer servers, known as node operators, miners or validators, but more commonly understood as data centers.

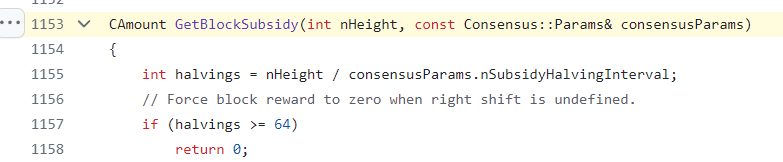

The limit is defined by these five lines of code:

The software dictates the issuance of new bitcoin as reward to the data center operators for validating transactions on the network. Based on the assumption that the price of bitcoin would increase, and the cost of compute (per Moore’s Law) would decrease, the author of the bitcoin software elected to have the units of bitcoin rewarded to decrease over time and, ultimately, to stop altogether. Direct Impact on Bitcoin’s Supply.

Halving the Block Reward

The Bitcoin halving event reduces by 50% the reward that miners receive for adding new blocks to the blockchain. For example, before the 2020 halving, miners received 12.5 BTC per block; after the halving, this reward fell to 6.25 BTC. This directly decreases the rate at which new Bitcoins are created and added to the circulating supply. After the next halving, expected on or about April 20, 2024, the validation reward will decrease again to 3.125 BTC.

Controlled Supply to Ensure Scarcity

Bitcoin’s design includes a capped supply of approximately 21 million coins, intended to prevent inflation. Halvings are a mechanism to ensure that the creation of new Bitcoins slows down over time, making Bitcoin scarcer as it approaches its maximum supply limit. This enforced scarcity is a fundamental aspect that influences Bitcoin’s value proposition, akin to precious metals like gold, with one very important caveat: if gold were to become worth 100x more than it is presently, additional extraction would become economically viable, and yet more gold would enter the market as new supply. Whereas, in the case of bitcoin, the issuance of new coins is on a predetermined and fixed schedule, regardless of the price of bitcoin (the cost of validating can fluctuate based on transaction demand, hardware costs, electricity costs and other factors but bitcoin are not created faster if more validators were to use more powerful equipment).

Indirect Influence on the Cryptocurrency Market

Price Dynamics

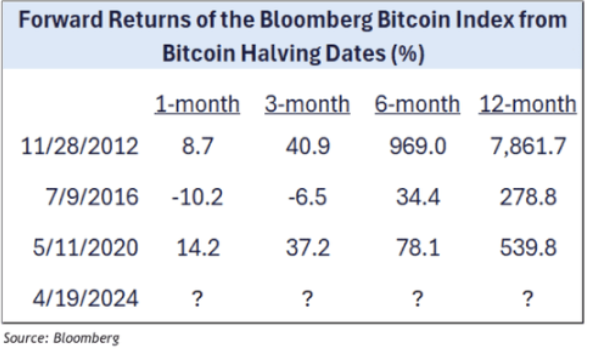

Historically, Bitcoin halvings have led to significant price increases in the months following the event. While these increases directly affect Bitcoin’s price due to perceived scarcity, they can also influence the broader cryptocurrency market. A substantial increase in Bitcoin’s price often leads to increased interest and investment in other cryptocurrencies, sometimes referred to as the “halo effect.”

Investor Sentiment

The halving tends to generate considerable media attention and speculative interest within the cryptocurrency community. This heightened awareness can lead to more investors entering the crypto market, not just investing in Bitcoin but exploring altcoins as well. This influx of investment can increase the market capitalization of the cryptocurrency market. Because many investors expect that the price of bitcoin may greatly increase, they are less likely to sell and more likely to borrow against their bitcoin holdings. This allows them to get liquidity without incurring capital gains tax and enables them to enjoy potential gains if the price of bitcoin increases. To address this demand, Medici Bank has recently begun offering loans against bitcoin and ether collateral.

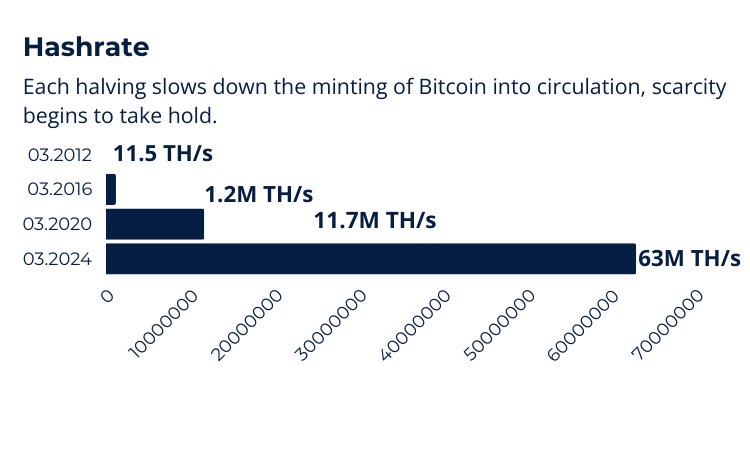

Mining Dynamics

Post-halving, some miners may find it less profitable to mine Bitcoin due to the reduced block reward, potentially leading them to switch to mining other cryptocurrencies or diversifying, such as hosting servers to power ai compute. This can alter the mining landscape and the distribution of hash power across different blockchain networks.

Innovation and Development

The anticipation and aftermath of a Bitcoin halving often spark discussions about scalability, sustainability, and the technological advancements of blockchain technology. This can encourage innovation not only within Bitcoin’s ecosystem but across the entire cryptocurrency market, as projects seek to address these challenges and capitalize on the increased interest in digital assets.

In summary, while the Bitcoin halving directly impacts Bitcoin’s supply by slowing the rate of new coin creation, it also indirectly influences the broader cryptocurrency market through changes in price dynamics, investor sentiment, mining distribution, and innovation within the space. These effects underscore Bitcoin’s significant role in the cryptocurrency ecosystem and how pivotal events within its economy can ripple through the entire market.

[gb]